Is Irm Stock Dividend Safe

Is irm stock dividend safe Payout ratio (fwd) fwd payout ratio is used to examine if a company’s earnings can support the current dividend payment amount. Iron mountain inc’s historic dividend cover is 0.43. Find the latest dividend yield (ttm) for iron mountain (irm) In this article, we will be taking a look at 10 safe dividend stocks to invest in. This is all good news for dividend safety, right? 112.27% based on the trailing year of earnings. The dividend payout ratio for irm is: That’s more than four times higher than the broader market’s yield. Accordingly, the fact that irm stock currently yields 5.1% is something that should raise investors’ eyebrows. To skip our detailed analysis of dividend investing, you can go directly to see the 5 safe dividend stocks to invest in.

8 Highest Dividend Stocks In Sp500 - Stock Market Tips - Ideas Of Stock Market Tips Stockmarketti Finance Investing Money Management Advice Budgeting Money

This is a defensive company with a strong balance sheet and competitive advantage i. The score is 96 out of 100. But even in a downturn, companies that provide the basics continue to thrive. After the turn of the century, companies such. Iron mountain distributes 93 percent of its earnings based on its earnings. Is iron mountains dividend safe?

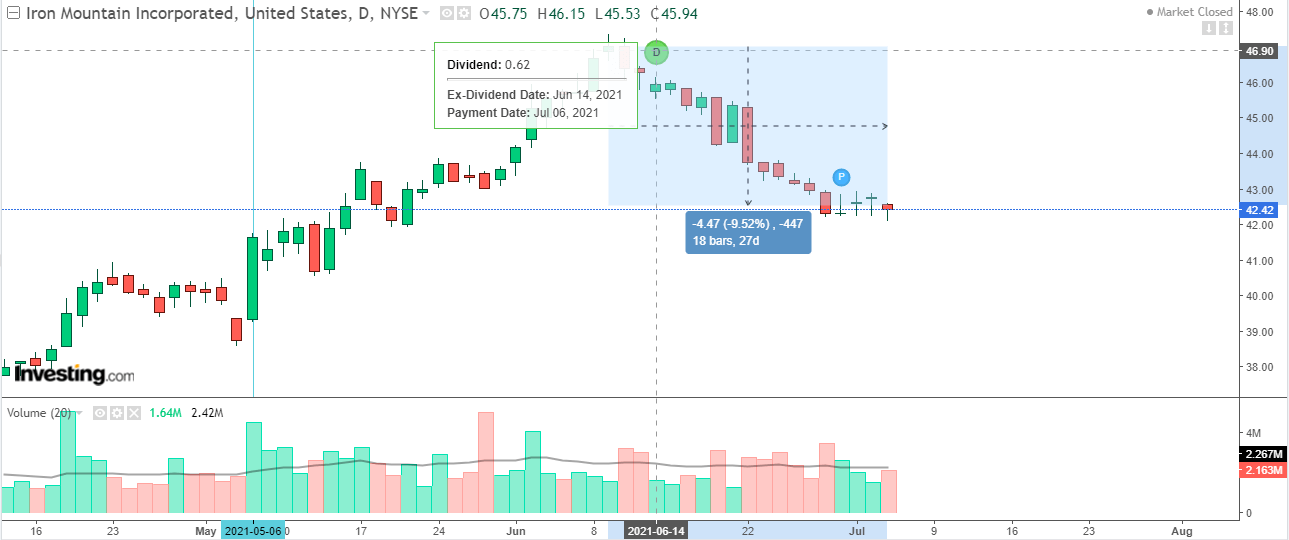

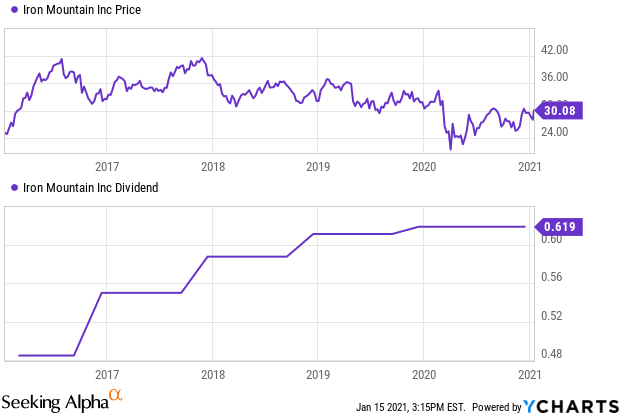

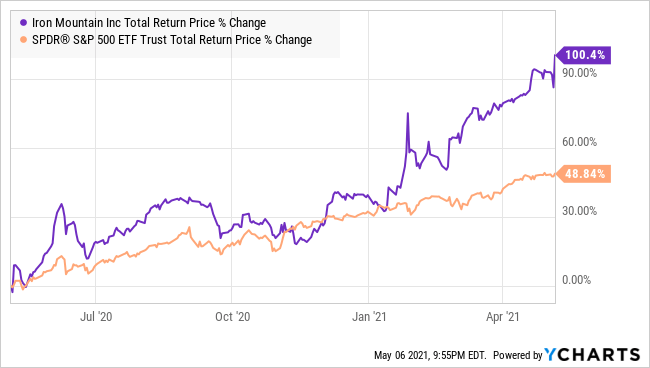

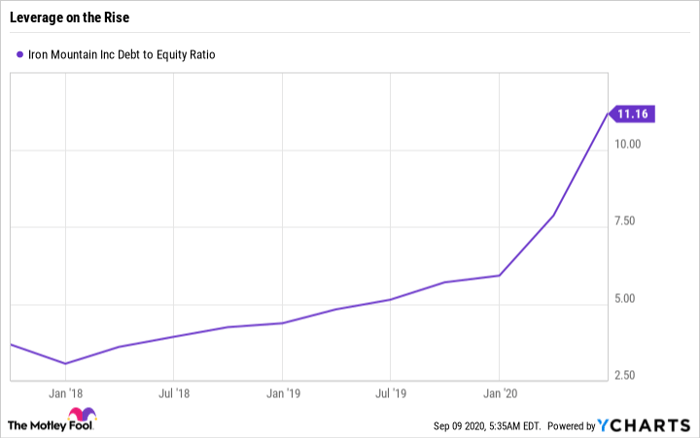

Is irm stock dividend safe. Meanwhile, the stock offers an iron mountain of a dividend. Third, irm did not raise its dividend last last year, which will lead to 0% dividend growth in 2021. Analysts have long prized this document. This group was comprised of 5 stocks, 3 of which sport high dividend yields in altria group (mo), iron mountain (irm) and omega healthcare investors (ohi). 70.26% based on cash flow. How safe are iron mountain and its dividend? Cash dividend payout ratio (ttm) f. The reit's payout ratio looks pretty good, but that's not the only thing investors need to consider when it. At the current stock price of $46.4, the dividend yield is 5.33%. Now, that yield comes with some drawbacks. Iron mountain, simply safe dividends although acquisitions still provide somewhat of a growth runway in developed markets, there is a limit to how much expansion can ultimately be achieved from this profitable core business, especially as more companies move to paperless (i.e. This is down from ~60 in the early 1980s and ~15 in 2000; If an investor has a low risk tolerance then msft’s aaa credit rating will be appealing. The rolling dividend cover for iron mountain inc, based on projected dividends and earnings, is 0.37. This page was last updated on 11/19/2021 by marketbeat.com staff. The historic dividend cover is based on historic dividends and earnings. Dividend yield (ttm) is a widely used stock evaluation measure. Both of these figures are below the 1.0x safety threshold for iron mountain inc that we have set. It divides the forward annualized dividend by fy1 eps. Can you trust iron mountain inc’s dividend payout? Not necessarily… iron mountain has raised its regular dividend in nine out of the last 10 years, and it has increased it by 30% over the last five years to $0.62 quarterly. Final word on irm stock. 88.85% based on this year's estimates.

Second, i’ve made a point of focusing on dividend safety within my portfolio recently. Best dividend capture stocks in nov. This list is comprised of businesses that are worth billions of dollars and generate. Iron mountain (irm) dividend data. How safe are iron mountain and its dividend? The reit's payout ratio looks pretty good, but that's not the only thing investors need to consider when it comes to gauging dividend safety. Still, the crucial thing to note here is that, at the heart of it, dividend stocks are a safe investment. 83.45% based on next year's estimates. But iron mountain has a consistently high payout ratio of more than 100% using funds from operations (ffo). The stock is one of dividend power’s best dividend growth stocks. Dividends of 9% to its shareholders are based on a metric that indicates their reliability. The key things to look at are future earnings and whether they are sustainable.

Iron Mountain Stock At Record Levels Still Has 65 Dividend

Iron Mountain Stock Is Too Expensive Despite Good Dividends Nyseirm Seeking Alpha

Iron Mountains 82 Yield High Risk High Reward Nyseirm Seeking Alpha

3 Under-the-radar High-yield Dividend Growth Stocks To Consider Buying Iron Mountain Irm Omega Healthcare Investors Ohi And Oneok Oke Dividends And Income

High-yield Or Dividend Growth Both Nyseirm Seeking Alpha

Leggett Platt Announces 3q 2020 Earnings Call Dividend Stocks Dividend Common Stock

Secure Cryptocurrency Payment Bitcoin Ethereum Shield Logo Vector Icon Set Digi Vector Logo Icon Set Vector Vector Icons

Iron Mountains High Yield Isnt Worth The Risk Nasdaq

Post a Comment for "Is Irm Stock Dividend Safe"